Posts by Anthony Islington

Top 20 Transformative Changes Technology is Bringing to the Financial Sector

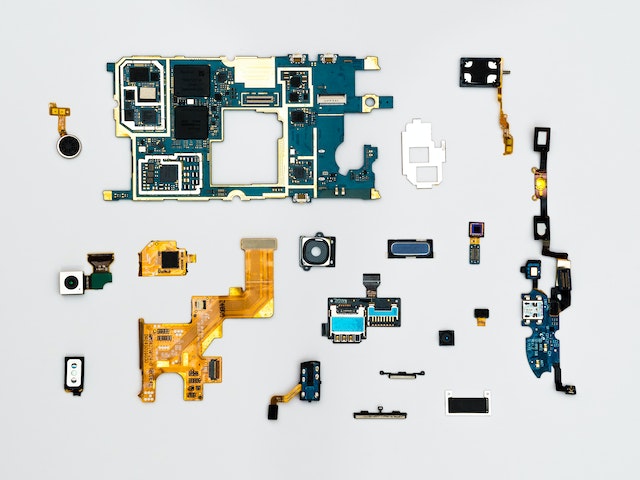

Title: Top 20 Transformative Changes Technology is Bringing to the Financial Sector Digital Payments: The rapid adoption of digital payments is redefining how transactions occur in the financial sector. This includes online banking, mobile wallets, and cryptocurrencies, which provide quicker and more convenient payment options. Blockchain: This decentralized and immutable ledger technology is impacting the…

Read MoreOpen Banking: Empowering Innovation and Customer-Centric Financial Services

Open Banking: Empowering Innovation and Customer-Centric Financial Services Introduction Open banking, enabled by Application Programming Interfaces (APIs), is transforming the financial landscape by fostering collaboration, innovation, and customer-centricity. It allows financial institutions to share customer data securely with third-party developers, empowering them to build applications and services that enhance the customer experience and deliver innovative…

Read MoreQuantum Computing: Unlocking the Potential for Data Processing and Encryption in the Financial Sector

Quantum Computing: Unlocking the Potential for Data Processing and Encryption in the Financial Sector Introduction Quantum computing is an emerging field of technology that has the potential to revolutionize data processing and encryption. It harnesses the principles of quantum mechanics to perform calculations and solve complex problems at an unprecedented speed and scale. In the…

Read MoreDecentralized Finance (DeFi): Unlocking Financial Opportunities on the Blockchain

Decentralized Finance (DeFi): Unlocking Financial Opportunities on the Blockchain Introduction Decentralized Finance (DeFi) has emerged as a transformative force in the financial industry, leveraging blockchain technology to revolutionize traditional financial systems. Unlike traditional finance, which relies on intermediaries such as banks and brokers, DeFi operates on decentralized platforms, enabling peer-to-peer transactions and eliminating the need…

Read MorePredictive Analytics: Unleashing the Power of AI and ML in Financial Institutions

Predictive Analytics: Unleashing the Power of AI and ML in Financial Institutions Introduction Predictive analytics has emerged as a game-changer for financial institutions, enabling them to harness the power of artificial intelligence (AI) and machine learning (ML) to make data-driven predictions and informed business decisions. By analyzing vast amounts of historical and real-time data, predictive…

Read MoreContactless Payments: Making Transactions Quicker and More Convenient

Contactless Payments: Making Transactions Quicker and More Convenient Introduction Contactless payments have revolutionized the way we make transactions, offering speed, convenience, and enhanced security. With the advent of Near Field Communication (NFC) and Radio Frequency Identification (RFID) technology, contactless payments have become increasingly popular in various industries, including retail, hospitality, and transportation. This article explores…

Read MoreCloud Computing: Cost-Effective, Scalable, and Secure Data Storage for Financial Institutions

Cloud Computing: Cost-Effective, Scalable, and Secure Data Storage for Financial Institutions Introduction Cloud computing has revolutionized the way businesses operate, offering cost-effective, scalable, and secure data storage solutions. Financial institutions, in particular, have embraced cloud technology to streamline operations, enhance data management, and improve overall efficiency. This article explores the role of cloud computing in…

Read MoreBig Data in Financial Institutions: Unlocking Insights and Driving Data-Driven Decisions

Big Data in Financial Institutions: Unlocking Insights and Driving Data-Driven Decisions Introduction In today’s digital era, financial institutions have access to vast amounts of data generated from various sources. Big data refers to the massive volumes of structured and unstructured data that can be analyzed to extract valuable insights and patterns. Financial institutions leverage big…

Read MoreRegtech: Driving Efficient and Cost-Effective Regulatory Compliance

Regtech: Driving Efficient and Cost-Effective Regulatory Compliance Introduction Regulatory compliance is a critical aspect of business operations, but it can be complex, time-consuming, and costly. Regtech, a term derived from “regulatory technology,” offers innovative solutions to help businesses comply with regulations efficiently and cost-effectively. Leveraging technologies such as artificial intelligence (AI) and machine learning (ML),…

Read MoreInsurtech: Disrupting the Insurance Sector with Technology

Insurtech: Disrupting the Insurance Sector with Technology Introduction Insurtech, the fusion of insurance and technology, is revolutionizing the insurance sector. Through the use of advanced technologies such as artificial intelligence (AI), machine learning, big data, and blockchain, insurtech is transforming the way insurance companies assess risks, manage claims, and provide customer service. This article explores…

Read More