Find out how technology is shaping the financial landscape.

Biometrics: Enhancing Security in Financial Transactions

Biometrics: Enhancing Security in Financial Transactions Introduction Biometric identification methods have emerged as powerful tools for enhancing the security of financial transactions. Technologies such as fingerprint scanning, facial recognition, and voice authentication offer unique and reliable ways to verify the identity of individuals. This article explores the impact of biometrics in the financial sector, discussing…

Cybersecurity in the Financial Sector: Safeguarding Against Cyber Threats and Data Breaches

Cybersecurity in the Financial Sector: Safeguarding Against Cyber Threats and Data Breaches Introduction As the financial sector becomes increasingly digital, the need for robust cybersecurity measures is paramount. With the growing reliance on technology and the digitization of financial services, the risk of cyber threats and data breaches has intensified. This article explores the importance…

Mobile Banking: Revolutionizing the Banking Industry

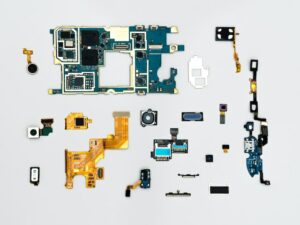

Mobile Banking: Revolutionizing the Banking Industry Introduction Mobile banking has become a transformative force in the banking industry. With smartphones in hand, consumers can perform most banking operations anywhere, anytime. This article explores the impact of mobile banking on the traditional brick-and-mortar banking model, discussing its benefits, challenges, and implications for both customers and financial…

Peer-to-Peer (P2P) Lending: Revolutionizing the Borrowing and Lending Experience

Peer-to-Peer (P2P) Lending: Revolutionizing the Borrowing and Lending Experience Introduction Peer-to-peer (P2P) lending has emerged as a disruptive force in the financial industry. This online platform connects lenders directly with borrowers, bypassing traditional banking systems. P2P lending offers a streamlined and efficient borrowing and lending experience, often providing more favorable rates for borrowers and attractive…

Robo-Advisors: Revolutionizing Personalized Investment Management

Robo-Advisors: Revolutionizing Personalized Investment Management Introduction Robo-advisors have emerged as game-changers in the world of investment management. These automated, AI-driven platforms offer personalized advice and portfolio management to clients, typically at a lower cost than traditional human advisors. This article explores the transformative impact of robo-advisors in the financial industry, discussing their features, benefits, and…

Artificial Intelligence (AI) in the Financial Sector: Revolutionizing Customer Service, Operations, and Security

Artificial Intelligence (AI) in the Financial Sector: Revolutionizing Customer Service, Operations, and Security Introduction Artificial Intelligence (AI) and Machine Learning (ML) algorithms have emerged as powerful tools for the financial sector. These technologies offer financial institutions the ability to enhance customer service, streamline back-office operations, analyze vast datasets quickly, and detect fraudulent activities. This article…

Blockchain: Revolutionizing the Financial Sector

Blockchain: Revolutionizing the Financial Sector Introduction Blockchain, a decentralized and immutable ledger technology, is making waves in the financial sector. With its ability to offer greater transparency, reduce fraud, and introduce innovative methods of transacting, such as cryptocurrencies and smart contracts, blockchain is reshaping the way we conduct financial transactions. This article explores the transformative…

Digital Payments: Transforming the Financial Landscape

Digital Payments: Transforming the Financial Landscape Introduction In the modern era, digital payments have experienced an unprecedented surge in adoption, reshaping the way transactions occur in the financial sector. Online banking, mobile wallets, and cryptocurrencies have emerged as game-changers, offering quicker, more convenient, and secure payment options. This article explores the transformative impact of digital…

Revolutionizing Insurance Claims with Artificial Intelligence

Artificial Intelligence (AI) is rapidly transforming industries across the globe, with the insurance sector being no exception. AI is making its mark by significantly improving the efficiency, accuracy, and customer satisfaction of the claim management process. Here, we explore how AI is revolutionizing the way insurance companies handle claims. The Traditional Claim Process – Slow…

Hello world!

Welcome to Elliott nights. This is your first post. Edit or delete it, then start writing!

- « Previous

- 1

- 2